Small to medium-sized businesses are among some of the most affected when it comes to late payments.

This has been a recurring theme in recent months. Our friends at Sage have delved into this subject a couple of times with posts on their extremely useful blog.

To summarise, here are some of the results and implications found in Sage research:

- 17% of all payments to SMEs are paid late

- UK SMEs spend 15 days per year chasing late payments

- More than 50% of UK SMEs currently experience or expect to experience a negative impact on company investment

- Unable to pay suppliers

- Unable to pay staff an annual bonus

The three key points which can be taken from this are that time is waste, the business’s reputation to suppliers is damaged due to late payments and staff are left unrewarded for their hard work.

It’s obvious that the effects of late payments have a more intense impact on smaller-sized businesses. Large firms have much higher cash reserves which allows them to operate while cash flow is stalled, as well as reward staff.

There are many manual techniques you can try to combat late payments, therefore regulating cash flow and maintaining good relationships with suppliers and employees:

- Clarify payment terms before a deal is made

- Ensure invoice is correct before sending

- Invoice at the earliest possible time

- Chase them as soon as they are late

It is unquestionable that these processes will reduce the amount that late payments affect your business and improve cash flow.

The key thing that they don’t save too much of is time, which is undoubtedly one of an SME’s most valuable resources. As we mentioned earlier in this post, UK SMEs spend 15 days per year chasing late payments.

Automation is the answer.

Aside from sparing you of those awkward conversations with your suppliers, automated credit control software reaps so many benefits.

The main ones being the 15 days a year spent on chasing late payments being allocated elsewhere and more money in your business’s bank account.

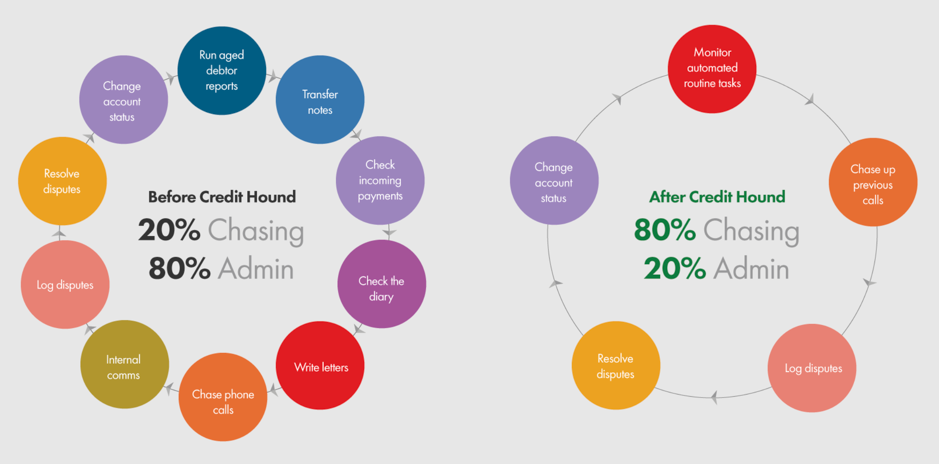

Credit Hound by Draycir allows businesses to tip the scales in terms of time spent on administration when chasing debts through the use of cutting edge, autonomous technology.

Traditional debt-chasing processes such as writing and sending email reminders are eradicated by Credit Hound and replaced by efficient, autonomous processes.

Credit Hound users no longer have to cross-reference their payment diary with their incoming payments, notice late payments and begin the prolonged debt-chasing process. It’ll even automatically place overdue accounts on hold, too.

Seamlessly integrating with Sage, Credit Hound ensures that all information is accurate and up-to-date as well as facilitating real-time reporting and to-do lists so you can effortlessly track the progress of your Credit Hound’s debt-chasing endeavours.

Credit Hound embodies what new digital technologies aspire to be:

A solution that saves time and money by increasing the efficiency of business processes.